When it comes to the world of taxes, knowledge is power. Businesses that know how to maximize their 179D deductions will find themselves miles ahead of the competition. With the newly released section 179D tax deduction expansion, it’s never been a better time for companies to take advantage of these new tax incentives.

This blog discusses the 179D tax deduction, how companies can qualify for the 179D energy-efficient deductions for commercial buildings, and how it will impact your tax planning strategy.

The 179D Deduction as of 2022

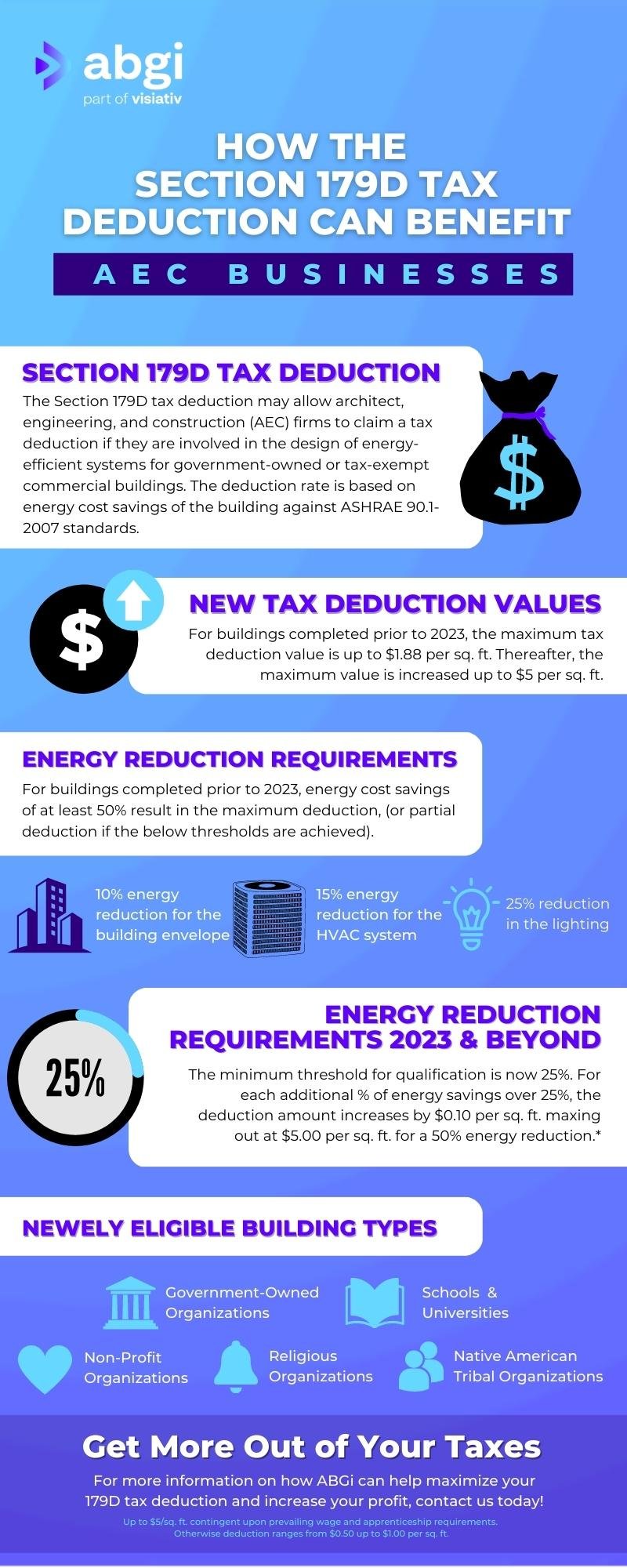

The primary purpose of the section 179D deduction is to provide tax incentives to commercial building owners, and qualifying AEC companies to reward the selection of energy-efficient systems in design, build or renovation projects. In 2022, architects, engineers, and construction companies could receive a total deduction of $1.88 per square foot of a qualifying commercial building.

The requirement for the 179D tax deduction was that commercial properties must prove they lower their yearly energy consumption by at least 50% compared to similar commercial buildings using ASHRAE standards.

The building systems that didn’t meet the full 50% energy reduction requirement could still earn partial deductions up to $0.63 per square foot by meeting any of the following thresholds against ASHRAE:

- 10% for the building envelope

- 15% for the HVAC system

- 25% for the interior lighting

Through 2022, the 179D deduction applies to privately owned and government-owned buildings. However, the government can't claim the 179D deduction as an owner because the government does not pay federal taxes.

In these cases, the IRC 179D code allows these tax benefits to pass to the companies with design input toward the government building.

Changes to the 179D Deduction in 2023

On August 16, 2022, the Inflation Reduction Act (IRA) was signed into law and came with a $369 billion investment into energy efficiency projects. The Inflation Reduction Act significantly changes the existing Internal Revenue Code (IRC) Section 179D tax deduction.

These adjustments provide a range of new guidelines for businesses responsible for designing, building, or renovating energy-efficient commercial buildings, the effects of which will appear in buildings placed into service starting in 2023.

This section breaks down these monumental changes to the 179D deduction 2023.

1. Reduced Qualification Thresholds

The IRA reduced the previous energy-saving qualification thresholds for the 179D deduction. Companies must now meet a 25% reduction in annual energy usage vs 50% in the years prior for all systems. For every additional reduction percentage above 25%, companies can see an increase in their deduction, capped at a 50% reduction. With the expansion of the 179D tax deduction under the new IRA guidelines, the government hopes more architectural and engineering firms will consider energy-efficient systems in their commercial building projects.

2. Revised Building Eligibility for AEC Firms

The IRA revisions to the 179D deduction allow for a broader range of tax-exempt commercial buildings that an AEC firm can use to claim a 179D tax deduction. This revised list includes non-profits, religious organizations, tribal organizations, government-owned and other organizations falling under IRC 501(c).

With these changes, architecture, engineering, and construction firms responsible for assisting with the design of these types of buildings can now receive further energy-efficient commercial building tax deductions on various projects.

3. New Deduction Values

The deduction rates may increase from $1.88 per square foot to $5 per square foot. See the graphic below for additional details.

How the 179D Deduction Changes Affect Your Business

So, how do the adjustments to the 179D deductions affect your business? Do they provide any potential benefits? Let’s look at the impact on your company and the types of firms eligible for the 179D energy-efficient commercial building tax deduction.

Architecture, engineering, and construction companies may fall under the segment of firms responsible for the design of energy-efficient systems in commercial buildings. If the AEC firm completes work with prevailing wage and apprenticeship requirements for a tax-exempt entity, they could be eligible recipients for the tax deduction up to $5 per square foot.

Remember that the 179D energy tax deduction aims to reward those involved in the design of energy-efficient government buildings. Regarding qualifying, there are limitations of section 179D deduction; a company must be responsible for selecting and/or designing the technical aspects within the energy-efficient systems, like the HVAC, interior lighting, and building envelope.

179D Tax Deduction for Architects and Engineers

Typically, many architecture and engineering firms find themselves responsible for the design of various technical specifications. As a result of that, both company types usually qualify for the 179D deduction having design input in the following categories:

- Building envelope

- Heating, ventilation, and air conditioning (HVAC) system

- Interior lighting system

The 179D tax deduction for architects and engineers presents several tax benefits and opportunities for firms that know their options.

179D Tax Deduction for Contractors

For construction firms to qualify for the 179D deduction, they must be involved in having input in the design process. The construction firms that work on “design-build” contracts when working on a government or tax-exempt commercial building have a better chance of qualifying than firms that only manage and build the project.

Get More Out of Your Taxes

Tax-saving strategies can be complicated – even for the most experienced business owners. With over 30 years of experience in the tax consulting sector, ABGi can help ensure you maximize your deductions and reduce your tax liabilities. For more information on how ABGi can help maximize your business’ 179D tax deduction and increase your net profits, contact us today!