The beer market is a multi-billion dollar industry in the U.S. that is only expected to grow more in the coming years. The industry continuously demands high-quality beers, new recipes, and improved ingredients. The processes involved in malting, mashing, fermenting, bottling, and aging the beer make this industry a strong candidate for claiming the Research and Development (R&D) tax credit. This tax credit was designed to incentivize U.S. companies to conduct innovative activities, increase research spending, and keep jobs in America.

Opportunity

Opportunity

Most beer brewers do not realize that tax benefits exist to reward the innovative methods and processes that go into brewing and crafting new beers. The time and resources invested in ensuring your beer remains competitive and in high demand without compromising on the beer’s quality are very technical and complex. These processes include developing new beer recipes, experimenting with unique ingredients, evaluating various brewing techniques such as roast time and hops varieties, and improving the quality of already existing beer recipes.

With the R&D tax credit now being permanent, the timing has never been better for brewmasters to tap this keg and pour some of these often-substantial credits for themselves:

-

- The R&D tax credit provides a dollar-for-dollar reduction in a company’s tax liability;

- In addition to current-year tax savings, the credit can generate a refund of taxes previously paid for open tax years (generally the prior three years); and

- The credit can be used as a carry-back for one year and a carry-forward for 20 years if your company does not have immediate utilization for these credits.

- For small businesses grossing less than $5 million in receipts, the credit can be refunded up to the lower of $250,000 or what the company has paid in social security payroll taxes.

- There is bipartisan legislation in the works that would expand the small business eligibility to cap $10 million and raise the refund cap to the lower of $500,000 or all payroll taxes paid.

Additionally, the rules for calculating and claiming the R&D tax credits have recently become more taxpayer-friendly. Meaning if your brewery has looked into R&D tax credits in the past but was worried about stringent qualification standards or the difficulty of the calculation itself, these recent changes should make you take another look:

-

- The Alternative Simplified Credit (ASC) method can now be elected on amended returns instead of only on original-filed returns. Introduced in 2006, the ASC equals 14% of total qualified research expenses that exceed 50% of the average qualified research expenses for the three preceding taxable years. This method is less complicated than the “regular credit” calculation created in 1981 and does not rely on antiquated data.

- The definition of prototypes has been more clearly defined and made easier to qualify. This is often where you will find opportunities for a large portion of qualified research expenses.

In addition to the federal R&D tax credit, over 35 states have an R&D incentive program. These state credits typically follow federal regulations but have different tax rates and utilization methods. As such, taxpayers can benefit from both federal and state R&D credits to minimize their tax liability and be paid to innovate while growing their local economy.

Qualifications

Qualifications

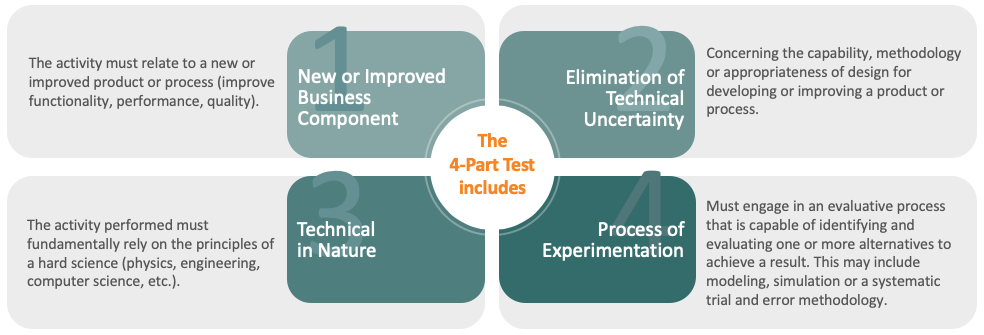

There is a common misconception that R&D only occurs in laboratories of high-tech research facilities. Still, the definition of R&D activity is quite broad and includes multiple industries and types of activities. The R&D tax credit utilizes a four-part test to determine what constitutes a qualified research activity (QRA):

THE FIRST PART OF THE TEST IS THAT THE ACTIVITY MUST RELATE TO A NEW OR IMPROVED PRODUCT OR PROCESS RELATING TO FUNCTION, PERFORMANCE, RELIABILITY, OR QUALITY.

This is anything ranging from developing a new beer recipe to implementing an improved manufacturing process that minimizes scrap products within the brewery. With every new emerging brewery, brewmasters are under intense pressure to continuously improve the quality of the beers they produce, requiring heavy investment in product development and testing. Activities related to making new beers, improving upon existing beers, or launching process improvements are referred to as business components.

THE SECOND PART OF THE TEST REQUIRES THE ELIMINATION OF A TECHNICAL UNCERTAINTY

This means the activities seek to discover information to eliminate uncertainty concerning the capability, methodology, or appropriateness of design for developing or improving a formula, product, or process. As a brewmaster, many challenges are presented throughout the entire beermaking process. For example, unexpected chemical changes during the brewing process or microbial contamination may put you back at square one, requiring the testing process to start completely over. Or perhaps there is uncertainty about whether the brewery is capable of making the beer because it is not equipped with the proper storage or measuring equipment to successfully control the precise variables in making certain types of beer. As an expert in the industry, you may have an initial conceptual idea for how to make a new beer. Still, certain constraints or inefficiencies are discovered during development which leads to changes and improvements to the final product. Lastly, food and beverage regulations place additional challenges to ensure compliance and/or improve shelf-life.

THE THIRD PART OF THE TEST REQUIRES A PROCESS OF EXPERIMENTATION

This means that the brewmaster must engage in a scientific process that analyzes one or more alternatives to achieve a result. Don’t let this test scare you off by envisioning lab coats and beakers! Although those types of activities certainly constitute a process of experimentation, this test includes anything from conducting yeast trials, testing scale-up methodologies, experimenting with new ingredients, evaluating various filtration techniques to prevent beer contamination, and testing different fermentation methods. The key here is the evaluation of alternatives:

![]() Did you develop prototype batches?

Did you develop prototype batches?

![]() Did you experiment with new ingredients to create a specific flavor profile?

Did you experiment with new ingredients to create a specific flavor profile?

![]() Did you attempt more than one mixing technique?

Did you attempt more than one mixing technique?

If you can answer “yes” to any of these questions, then your winery is most likely undergoing a process of experimentation! As you go through your development process, you will certainly evaluate various ways of finding a technical solution.

FINALLY, THE FOURTH PART OF THE TEST REQUIRES THAT THE ACTIVITY PERFORMED MUST BE TECHNOLOGICAL IN NATURE, AND FUNDAMENTALLY RELY ON PRINCIPLES OF CHEMISTRY, PHYSICAL OR BIOLOGICAL SCIENCE, ENGINEERING, ETC.

This is an easy one. This is an easy one. Brewmasters are continuously using the principles of chemistry, food science, industrial engineering, and mechanical engineering to make and test new beers. For example, did you conduct an analysis of the beer’s chemical composition in a lab? Did you analyze the scale-up requirements to take a recipe from small batch to large batch production? Maybe you evaluated your formulation to ensure there would be no microbial contamination. Any of these actions demonstrate your reliance on hard science principles.

Credits

Credits

So now that we have identified your qualified research activities, how does that translate into tax credits? These activities generate qualified research expenditures (QREs) that fall into one of three buckets: wages, supply costs, and contractor costs.

WAGES – this consists of qualified wage expenses identified through direct wages of technical employees or primary research personnel (along with support or supervisory personnel) who affect the research. For breweries, this can include Senior and Assistant brewmasters, chemists, and any person providing direct support to those employees (such as brewers and lab technicians.

SUPPLY COSTS – supplies consist of items consumed in the research and experimentation process. This would include the materials (batch costs) used throughout the trial-and-error process when testing new formulations and ingredients.

CONTRACTOR COSTS – these are comprised of payments made to a third party to perform qualified research along with fees paid to consultants or outside testing firms. An example in the beer industry would be any costs associated with utilizing a third party to provide certain tests on a new product or equipment as required by a regulatory body.

ABGi USA

Business leaders choose ABGi as their tax incentive specialist because, for over 30 years, our expertise has allowed us to maximize their credits and deductions, decreasing tax liability the way the government intended. Our approach to work minimizes business disruption and produces high-quality, compliant work.

Contact us today!