The wine market is a multi-billion dollar industry in the U.S. that is only expected to grow more in the coming years. The industry continuously demands high quality wines, new blends, and improved ingredients. The processes involved in growing, irrigating, harvesting, blending, and aging wine make this industry a strong candidate for claiming the Research and Development (R&D) tax credit. This tax credit was designed as an incentive for U.S. companies to conduct innovative activities, increase research spending, and keep jobs in America.

Opportunity

Opportunity

Most winemakers and vineyards do not realize that tax benefits exist to reward the innovative methods and processes that go into harvesting and making wine. The time and resources invested to ensure your wine remains both competitive and in high-demand without compromising the wine’s flavor profile are very technical and complex. These processes include developing new wine varietals, conducting yeast trials, evaluating various filtration techniques, and improving the quality of existing wine blends.

With the R&D now being permanent, the timing has never been riper (pun intended) for winemakers to take advantage of these often-substantial credits:

-

- The R&D provides a dollar for dollar reduction in a company’s tax liability;

- In addition to current year tax savings, the credit can generate a refund of taxes previously paid for open tax years (generally the prior three years); and

- The credit can be used as a carry-back for one year and a carry-forward for 20 years if your company does not have immediate utilization for these credits.

Additionally, the rules for calculating and claiming the R&D have recently become more taxpayer-friendly. Meaning, if your winery or vineyard has looked into the R&D in the past but was worried about stringent qualification standards or the difficulty of the calculation itself, these recent changes should make you take another look:

-

- The Alternative Simplified Credit (ASC) method can now be elected on amended returns instead of only on original-filed returns. Introduced in 2006, the ASC is equal to 14% of total qualified research expenses that exceed 50% of the average qualified research expenses for the three preceding taxable years. This method is less complicated than the “regular credit” calculation created in 1981 and does not rely on antiquated data.

- The definition of prototypes has been more clearly defined and made easier to qualify. This is often where you will find opportunities for a large portion of qualified research expenses.

In addition to the federal R&D, over 35 states have an R&D incentive program. These state credits typically follow federal regulations but have different tax rates and utilization methods. As such, taxpayers can benefit from both federal and state R&D credits to minimize their tax liability and be paid to innovate while growing their local economy.

Qualifications

Qualifications

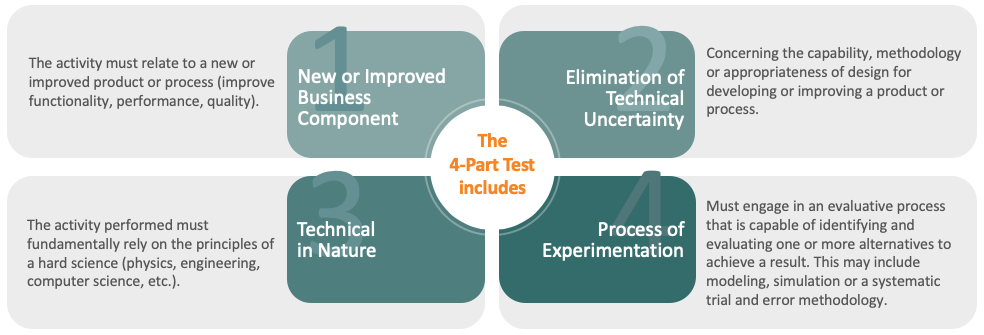

There is a common misconception that R&D only occurs in laboratories of high-tech research facilities, but the definition of R&D activity is quite broad and includes multiple industries and types of activities. The R&D tax credit utilizes a four-part test to determine what constitutes a qualified research activity (QRA):

THE FIRST PART OF THE TEST IS THAT THE ACTIVITY MUST RELATE TO A NEW OR IMPROVED PRODUCT OR PROCESS RELATING TO FUNCTION, PERFORMANCE, RELIABILITY, OR QUALITY.

This is anything ranging from the development of a new blend or varietal of wine to implementing an improved manufacturing process that minimizes scrap product within the winery. With each harvest, wine makers are under intense pressure to continuously improve the quality of the wines they produce, which requires heavy investment in product development and testing. Activities related to making new wines, improving upon existing wines, or launching process improvements are referred to as ‘business components’.

THE SECOND PART OF THE TEST REQUIRES THE ELIMINATION OF A TECHNICAL UNCERTAINTY

This means the activities are seeking to discover information to eliminate uncertainty concerning the capability, methodology, or appropriateness of design for developing or improving a formula, product, or process. As a wine maker, there are many challenges presented throughout the entire wine-making process. For example, you may not know the appropriate ratios of ingredients required to improve the quality of a specific wine. Additionally, unexpected chemical changes during the fermentation process or microbial contamination may put you back at square one, requiring the testing process to start completely over. You may have uncertainty regarding whether the winery is capable of making the wine because it is not equipped with the proper irrigation and filtration systems to successfully cultivate grapes. As an expert in the industry, you may have an initial conceptual idea for how to make a new blend, but certain constraints or inefficiencies are discovered during development, which lead to changes and improvements to the final product. Lastly, food and beverage regulations place additional challenges to ensure compliance and/or improve shelf-life.

THE THIRD PART OF THE TEST REQUIRE A PROCESS OF EXPERIMENTATION

This means that the winemaker must engage in a scientific process that analyzes one or more alternatives to achieve a result. Don’t let this test scare you off by envisioning lab coats and beakers! Although those types of activities certainly constitute a process of experimentation, this test includes anything from conducting yeast trials, testing scale-up methodologies, experimenting with new ingredients, evaluating various filtration techniques to prevent wine contamination, and testing different fermentation methods. The key here is the evaluation of alternatives:

![]() Did you develop prototype batches?

Did you develop prototype batches?

![]() Did you experiment with a new combination of ingredients or nutrients to achieve a specific flavor profile?

Did you experiment with a new combination of ingredients or nutrients to achieve a specific flavor profile?

![]() Did you attempt more than one mixing technique?

Did you attempt more than one mixing technique?

![]() Did you run barrel trials to determine whether a certain barrel would improve the quality of wine?

Did you run barrel trials to determine whether a certain barrel would improve the quality of wine?

![]() Did you experiment with multiple ratios of other wines to make a new blend?

Did you experiment with multiple ratios of other wines to make a new blend?

If you can answer “yes” to any of these questions, then your winery is most likely undergoing a process of experimentation! As you go through your development process, you will certainly evaluate various ways of finding a technical solution.

FINALLY, THE FOURTH PART OF THE TEST REQUIRES THAT THE ACTIVITY PERFORMED MUST BE TECHNOLOGICAL IN NATURE, FUNDAMENTALLY RELY ON PRINCIPLES OF CHEMISTRY, PHYSICAL OR BIOLOGICAL SCIENCE, ENGINEERING, ETC.

This is an easy one. Wine makers are continuously using the principles of chemistry and food science to make and test new wines. For example, did you conduct an analysis of the wine’s chemical composition in a lab? Did you evaluate yeast enzymes and tank fermentation results? Did you test varying mixing methodologies for optimal consistency? Perhaps you analyzed the rate of evapotranspiration to ensure the best soil conditions for grape cultivation. Maybe you evaluated your formulation to ensure there would be no microbiological contamination. Any of these actions demonstrate your reliance on hard science principles.

Credits

Credits

So now that we have identified your qualified research activities, how does that translate into tax credits? These activities generate qualified research expenditures (QREs) that fall into one of three buckets: wages, supply costs, and contractor costs.

WAGES – this consists of qualified wage expenses, which includes the direct wages of technical employees or primary research personnel, along with support or supervisory personnel, who affect the research. For wineries, this can include Senior and Assistant Wine Makers, Enologists, and any personnel providing harvest and cellar support.

SUPPLY COSTS – supplies consist of items used in the research and experimentation process. This includes the materials used throughout the trial-and-error process when testing new formulations and ingredients.

CONTRACTOR COSTS – these are comprised of payments made to a third party to perform qualified research along with fees paid to consultants or outside testing firms. An example in the wine industry would be any costs associated with utilizing a third party to provide certain tests on a new product or equipment as required by a regulatory body.

About ABGi

Business leaders choose ABGi as their tax incentive specialist because, for over 30 years, our expertise has allowed us to maximize their credits and deductions, decreasing tax liability the way the government intended. Our approach to work minimizes business disruption and produces high-quality, compliant work.

Contact us today!