INFORMATION CENTER:

Government support of research and development (R&D) may be appropriate when the social benefits associated with research activities exceed the private benefits. In the absence of such intervention, a market economy would tend to underinvest in research that leads to new ideas, discoveries and knowledge that are helpful in supporting a growing economy. There are numerous ways that governments seek to increase research activity. This paper describes and analyzes one prominent tax expenditure, the research and experimentation (R&E) credit, which encourages businesses in the U.S. to increase investment in research activities.

Current Law Description

Current Law Description

Originally enacted in 1981, the R&E credit was temporarily extended 16 times before finally being made permanent in the Protecting Americans from Tax Hikes (PATH) Act of 2015.

The R&E credit is incremental, the credit amount equals the applicable credit rate times the amount of qualified research expenses (QRE) above a base amount. Under current law, taxpayers may choose one of two methods to calculate the credit.

First, under the regular or “traditional” method the credit rate equals 20 percent and the base amount is the product of the taxpayer’s “fixed base percentage” and the average of the taxpayer’s gross receipts for the four preceding years. The taxpayer’s fixed base percentage is the ratio of its research expenses to gross receipts for the 1984-1988 period. A modified rule is used for taxpayers not in existence during the 1984-1988 time period to determine the fixed base percentage. The base amount cannot be less than 50 percent of the taxpayer’s QRE for the taxable year.

Second, taxpayers can elect the alternative simplified credit (ASC), which equals 14 percent of QRE that exceed a base amount defined as 50 percent of the average QRE for the three preceding taxable years. The ASC rate is reduced to six percent if a taxpayer has no QRE in any of the three preceding taxable years.

Taxpayers are also allowed to deduct (expense), instead of capitalize, research and experimental expenditures. However, taxpayers must either reduce the amount of their deduction of research expenditures by the amount of the credit claimed, or elect to take a smaller credit, one reduced by a proportion equal to the maximum statutory corporate tax rate. (More than 90 percent of corporate taxpayers elect the reduced credit). This “reduced” credit decreases the credit rate from 20 percent to 13 percent under the regular method and from 14 percent to 9.1 percent under the ASC. The proportional adjustment is roughly equivalent to reducing the size of deductible research expenses by the amount of the credit.

QRE include both in-house research expenses and contract research expenses. In-house research expenses include wages, supplies, and computer leasing expenses. Generally only 65 percent of payments for qualified research by the taxpayer to an outside person is included as contract research expenses, except in the case of payments to a qualified research consortium, 75 percent of the payments is included. Qualified research must be undertaken for purpose of discovering information that is technological in nature, must be intended to be useful in the development of a new or improved business component, and substantially all of the activities must relate to a process of experimentation concerning a new or improved function, performance, reliability or quality.

The R&E credit is a component of the general business credit and is generally not allowed to offset alternative minimum tax (AMT) liability. Credit amounts not claimed on the current-year tax return receive a one-year carryback or a carryforward of up to 20 years. The recently passed PATH Act of 2015 created two exceptions to the normal general business credit rules for certain small businesses beginning in 2016. First, eligible small businesses with gross receipts less than $50 million averaged over the past 3 years may apply the credit against AMT liability. Second, a qualified small business may elect to claim up to $250,000 of R&E tax credit as a payroll tax credit against its employer share of Social Security old age, survivors, and disability insurance (OASDI) taxes. To qualify for this payroll tax credit, the gross receipts of the taxpayer must be less than $5 million in the taxable year, and the taxpayer must not have had gross receipts in any taxable year before the 5-year period ending with the current taxable year. For certain research activities, the R&E tax credit allows a separate credit calculation equal to 20 percent of: (1) basic research payments above a base amount; and (2) all eligible payments to an energy research consortium for energy research.

Use of the Credit

Use of the Credit

The R&E credit is one of the largest business tax expenditures. In the past, however, the estimates of its size presented the tax expenditure budget frequently have been understated because the credit was temporary and its revenue effects were assumed to expire on schedule. In recent years, the credit had often expired at the time of the calculation and the tax expenditure reported in the Administration’s budget primarily reflected the use of the large stock of carry forward credit from previous years. For example, in the Fiscal Year 2017 budget, the estimated cost of the R&E credit equaled $20.6 billion for fiscal years 2016-2025 reflecting the expiration of the credit at the end of 2014 under the law at that time. Now the credit is permanent and the recently released Office of Tax Analysis (OTA) estimate of the tax expenditure has increased to $148.0 billion for fiscal years 2017-2026. This ranks the credit as one of largest business tax expenditures over the budget window.

For 2012, a total of $11.6 billion of current-year credit was reported on corporate and individual returns. Corporations accounted for $10.8 billion (93 percent) of the total. However, for a couple of reasons this is not an accurate measure of the revenue loss for that year as a result of the credit. First, taxpayers must either reduce the amount of their deduction of research expenditures by the amount of the credit claimed, or elect to take the reduced credit. In recent years, more than 90 percent of corporate taxpayers chose the reduced credit. But for those who do not choose the reduced credit, an adjustment must be calculated to account for the value of the lost deductions to equalize the value of the credit reported to those taxpayers who use the reduced credit.

Second, many taxpayers do not have current-year tax liability for which to take advantage of the credit immediately. In recent years, roughly half of the current-year credit for both corporate and individual taxpayers is not used in the current taxable year. The credits not used in the current year receive a one-year carryback or a 20-year carryforward. Recent improvements to Form 3800 provide information on the different types of general business credit carryforwards. In 2012, corporations reported $27.3 billion in R&E credit carryforwards, another $0.8 billion in R&E credit carryforwards were reported on individual returns.

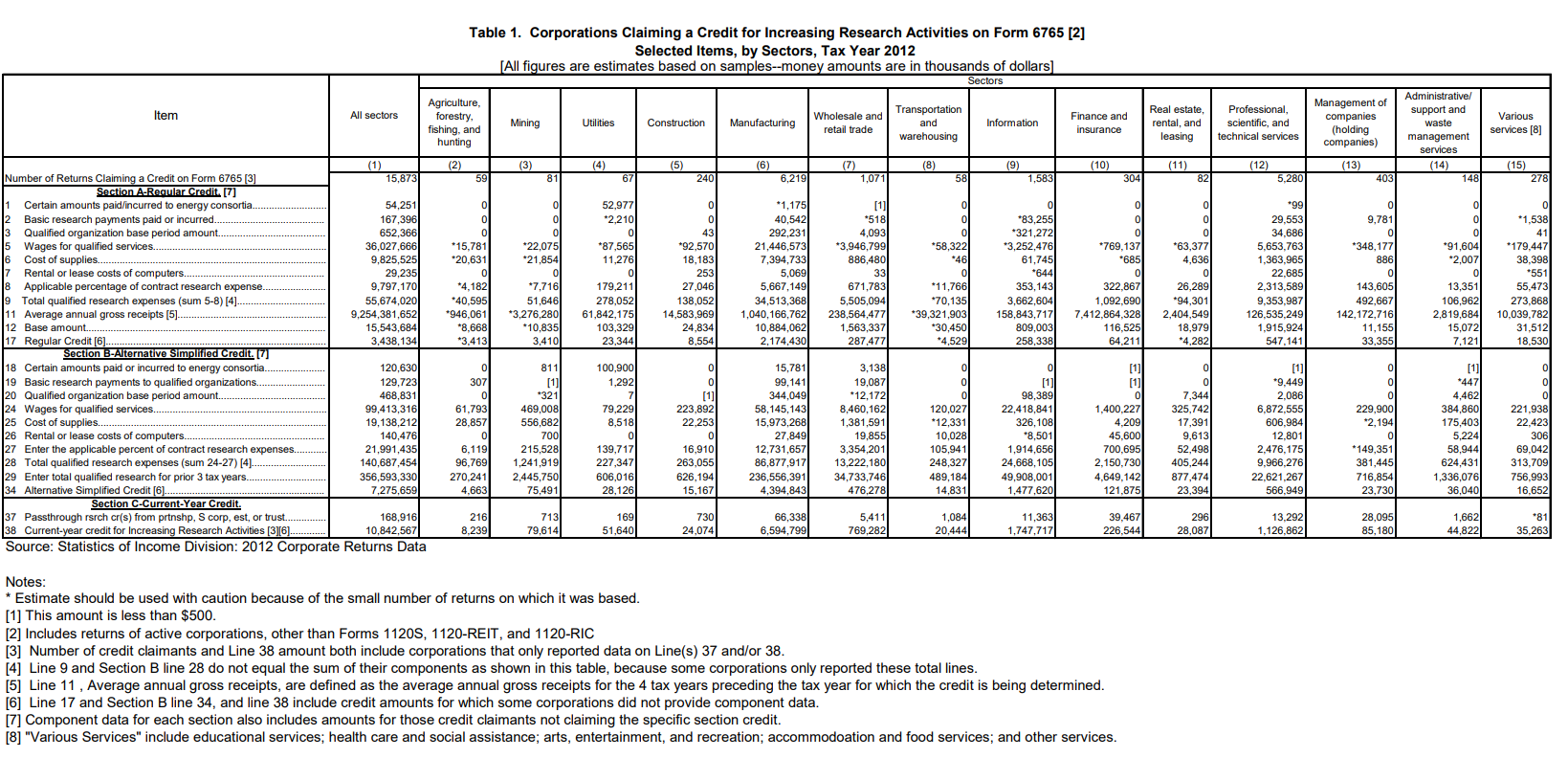

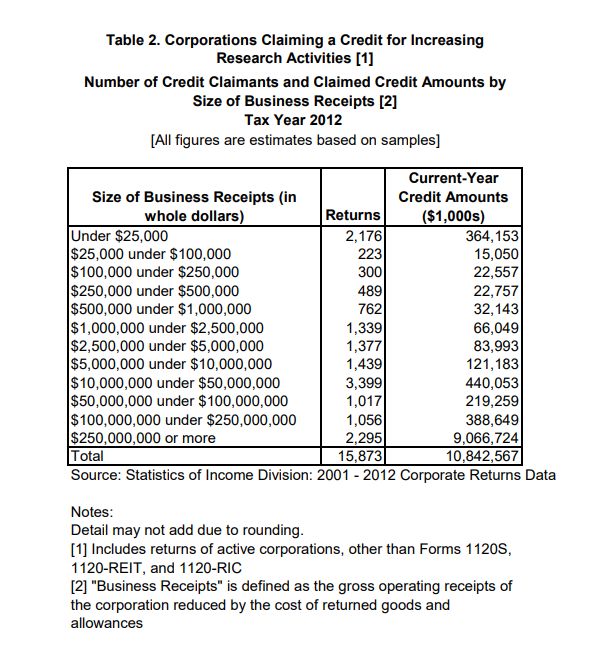

Details on the use of the credit for corporate taxpayers in 2012 by sector and size of business are shown in Tables 1 and 2.9. By far the largest sector claiming the research credit was manufacturing, with 6,219 corporate manufacturers claiming almost $6.6 billion of tax credits, which comprises 39 percent of the 15,873 corporate returns and 61 percent of the $10.8 billion in total current-year credits. The largest businesses, i.e., those with receipts of $250 million or more, accounted for 14 percent of all corporate tax filers claiming the credit, but for 84 percent of the total amount of credits claimed. Corporations with gross receipts less than $50 million accounted for just over 72 percent of the returns, but less than 11 percent of the current-year credit. Similarly, 42 percent of the returns belonged to corporations with gross receipts under $5 million, but these small taxpayers generated less than 6 percent of the current-year credit.

Approximately 69 percent of QRE spending is for wages and salaries. Another 15 percent goes towards supplies, and contract research expenses account for 16 percent of QRE. Expenditures for the rental or lease cost of computers accounts for a negligible percentage of QRE. Corporations using the regular method accounted for approximately 31 percent of QRE, while firms using the ASC comprised the remaining 69 percent of QRE.

Effect of the Credit on R&E Incentives

Effect of the Credit on R&E Incentives

The credit is intended to subsidize increases in R&E investment above a baseline level. Because the credit is calculated based on incremental investment, and because taxpayers have options for calculating the value of the credit, measuring the incentive effects of the credit is complicated. This section summarizes these incentives. First we calculate the marginal credit rate on incremental R&E expenditures—how much additional tax savings firms receive from increasing their expenditures—and describe how that incentive varies across firms and compares to the average credit rate. Second, to understand how this affects incentives to invest in research, we compare the treatment of marginal research investments to investments in tangible property.

Most corporate taxpayers use the ASC method (51 percent) where the average and effective rates are nearly equal, and these taxpayers account for 69 percent of the research expense reported on tax returns. For taxpayers using the regular method, most are constrained by the 50 percent minimum base and in effect face a flat-rate credit. These taxpayers account for 44 percent of corporate returns and 28 percent of research spending. Under assumptions we describe below, the required user cost of capital for investment in R&D falls by 15 to 26 percent below an alternative investment in a piece of equipment, which translates to a reduction in the required rate of return of approximately 3 to 6 percentage points.

The primary unit of measurement for this discussion will be the present value change in tax liabilities for a marginal one dollar increase in QRE in the current taxable year, which will be labeled the “effective credit rate.” The effective credit rate can vary by the method of calculation, the pattern of research investment over time for the firm, and the tax position of the taxpayer. The average credit rate is also calculated, which is defined as the current-year credit divided by total current-year QRE. In all examples, the taxpayer is assumed to elect the reduced credit.

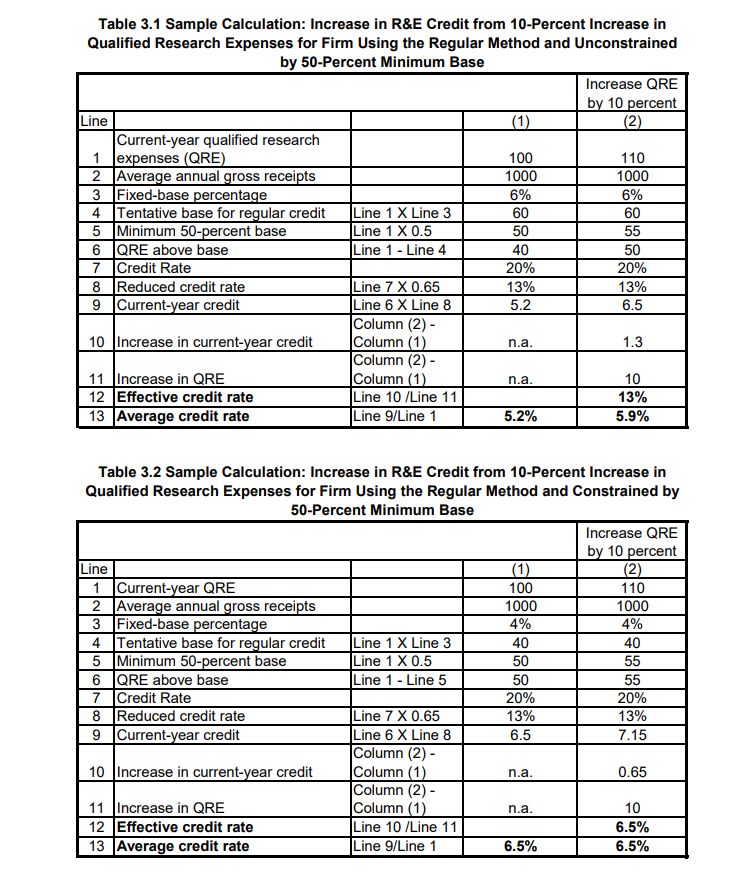

Sample calculations are provided in Tables 3.1-3.3 for taxpayers using the regular method and the ASC. In each case, the taxpayer is assumed to already have $100 of QRE for the taxable year and then calculates the tax consequences of increasing QRE by 10 percent, to a total of $110. Table 3.1 considers a taxpayer using the regular method where the base amount of $60 exceeds the 50-percent minimum base. For this taxpayer, the full $10 of increased QRE faces the reduced credit rate of 13 percent, implying the effective credit rate also equals 13 percent. The average credit rate is below the marginal effective credit rate as the only the portion of expenditures above the base amount is eligible for the credit. Increasing QRE by $10 increases the average credit rate from 5.2 percent to 5.9 percent as a greater portion of current-year QRE would be above the base amount.

Table 3.2 shows a similar situation, only in this case the base amount of $40 is less than 50 percent of the current-year QRE. This taxpayer is constrained by the 50-percent minimum base requirement. Hence, the $10 increase in QRE also increases the minimum base by $5, implying that the amount of QRE above the base only increases by $5 (see line 6). The increase in credit is then only half as large as in the previous unconstrained example, implying the effective credit rate equals 6.5 percent. The average credit rate equals 6.5 percent before and after the increase in QRE. This illustrates that for taxpayers in the situation, the regular credit is not incremental, but functions as a flat 6.5 percent credit.

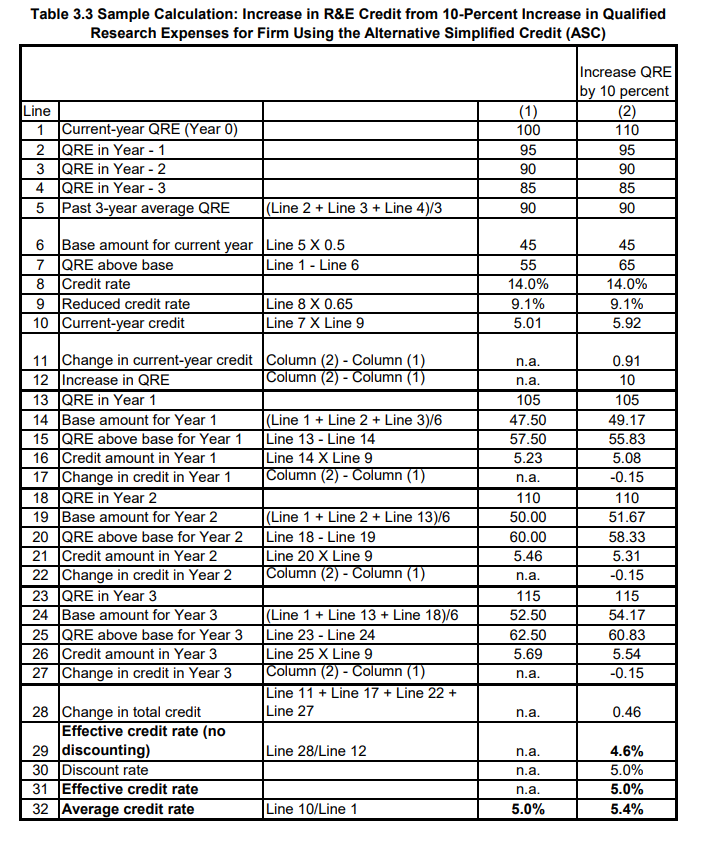

To calculate the effective credit rate under the ASC, shown in Table 3.3, it is necessary to include the effect of increasing current-year QRE spending on the base amount for the next three years.10 In the current-year (Year 0 in the table) the full amount of the $10 increase in QRE faces the reduced credit rate of 9.1 percent. However, the base amount for each of the next 3 years increases by $1.67, which leads to a decline in the credit received in each of those years of a little more than $0.15. In sum, the increase in current-year credit of $0.91 is offset by a decline in future credits of $0.455. With no discounting of the future credits, the total increase in credits equals $0.455, implying an effective credit rate (4.55 percent) which is half of the reduced rate. Assuming a discount rate of 5 percent, the effective credit rate increases to 5.0 percent. This is very close in magnitude to the average credit rate, which increases from 5.0 percent to 5.4 percent in this example with the increase in QRE.

While these sample calculations portray the typical situation for a firm, there also can be situations where the regular method provides no incentive to increase research on the margin. This could happen if the base amount is larger than the planned level of current-year research. Similarly, under the ASC, the effective credit rate can actually be negative if the planned level of research falls below the base amount. For such firms, marginal increases in research do not generate any current-year credit but increase the base amount of research that will apply in subsequent years. In this case, the effective credit rate is negative because increases in current year research provide no current-year credit and reduce future credit eligibility.

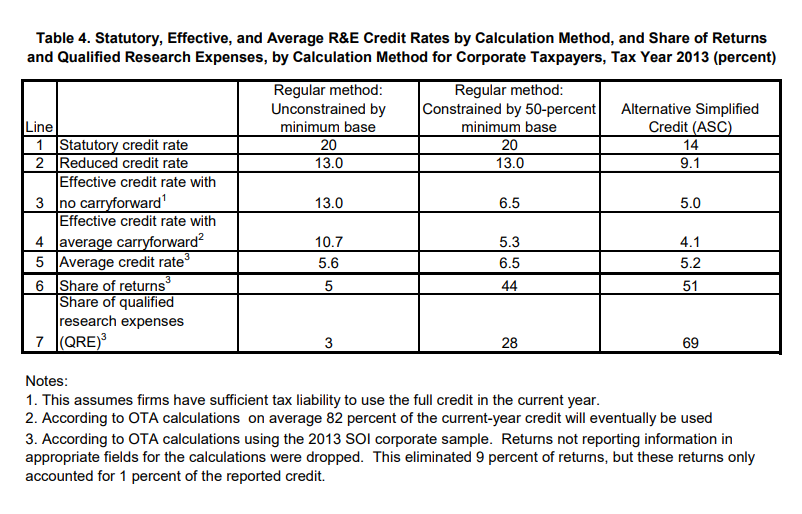

Table 4 summarizes these effective rate calculations and augments them with information from the SOI sample of corporate tax returns for 2013 and other years. The effective credit rates calculated in Tables 3.1-3.3 assume taxpayers are able to use the full amount of the credit to offset current-year (or the previous year) tax liability. In reality, a substantial portion of taxpayers are not able to use the credit in the current year and must carryforward the credit to future years. Based on SOI data, OTA calculates that on a present value basis, 82 percent of the credit will eventually be used assuming a 5 percent discount rate. Thus the effective credit rates of 13, 6.5, and 5.0 percent shown on Line 3 of Table 4 equal 10.7, 5.3, and 4.1 percent, respectively, once the typical amount of carryforward credit is considered (Line 4).

While it is important to understand the marginal incentive effects for each calculation method, taxpayers also care about the total credit received, as reflected by the average credit rate, particularly when choosing the calculation method used when filing the return. The average credit rate reported in Table 4 is based on the 2013 SOI sample of corporate tax returns and is calculated as the total reduced credit divided by the total current-year level of QRE for firms using each method.

The average credit is highest at 6.5 percent for those firms constrained by the 50 percent minimum base for the regular method. For firms using the regular method and not constrained by the minimum base, the average credit can range between 0 and 6.5 percent depending on how close the historical base is to the current-year research spending. For the full sample, the average credit rate for these firms is 5.6 percent. For firms using the ASC, the average credit rate equals 5.2 percent, which is actually higher than the marginal effective credit rate of 5.0 percent when assuming a 5 percent discount rate.15 If the assumed discount rate were instead 8 percent, then the effective and average credit rates would equal under the ASC.

Examining the results for effective and average rates in Table 4, along with the share of research conducted by taxpayers using each of the methods, indicates that the incentive effects of the credit are not much different from a flat-rate credit for most taxpayers. Most corporate taxpayers use the ASC method (51 percent) where the average and effective rates are nearly equal, and these taxpayers account for 69 percent of the research expense reported on tax returns. For taxpayers using the regular method, most are constrained by the 50 percent minimum base and in effect face a flat-rate credit. These taxpayers account for 44 percent of corporate returns and 28 percent of research spending. The final category of taxpayers where the credit is decidedly incremental, those using the regular method and not constrained by the minimum base, account for only 5 percent of corporate returns and 3 percent of research spending.

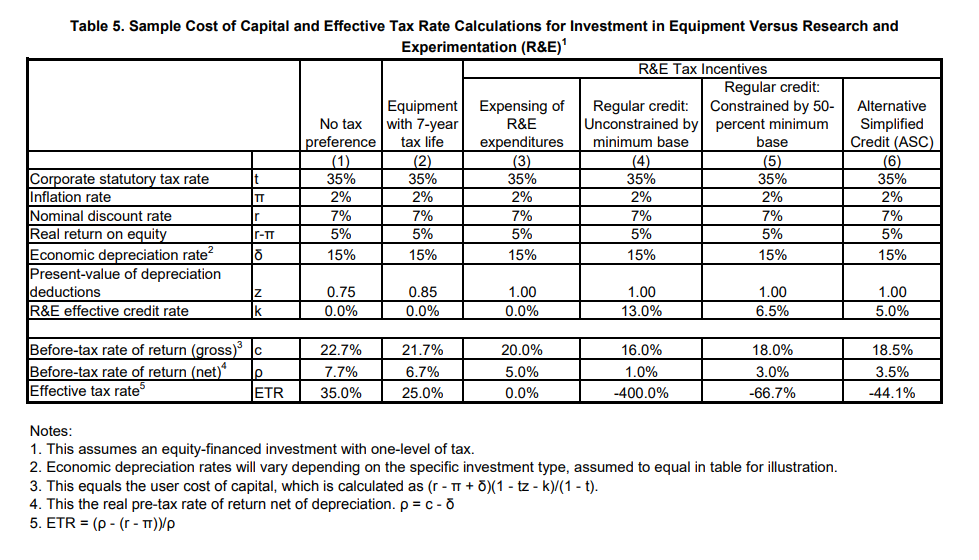

How does the combination of the expensing and the R&E credit affect the incentive to invest in R&D versus alternative investments? Table 5 provides illustrative calculations of the depth of the current tax subsidy to R&E investment compared to an alternative investment in tangible property. All investments are assumed to earn the same real after-tax rate of return of 5 percent, and the table calculates the effective tax rate (ETR), which is the tax wedge between the before and after-tax rate of return. For simplicity, these calculations assume there is only one level of tax at 35 percent and the investment is equity-financed. If the cost of the investment were recovered at the economic rate of depreciation, then the required before-tax rate of return, net of depreciation, equals 7.7 percent and the ETR equals the statutory rate of 35 percent. For investment in equipment, depreciation deductions are generally accelerated relative to economic depreciation. Table 5 shows the case for an investment in a generic piece of equipment with a 7-year tax life. The required before-tax rate of return falls to 6.7 percent and the ETR equals 25 percent.

Providing expensing of R&E expenditures reduces the ETR to zero, as the before-tax rate of return equals the 5 percent after-tax rate of return. This occurs because the upfront deduction for the full cost of the investment equals in present value the amount of tax due on the normal return to the investment. The R&E credit reduces the before-tax rate of return below the after-tax rate of return, which implies a negative ETR. If the firm faced the 13 percent effective credit rate under the regular method, then the before-tax rate of return would fall to 1 percent. When the effective rate under the regular credit is 6.5 percent, then the required before-tax rate of return equals 3 percent. Under the ASC, the 5 percent effective credit rate leads to a before-tax rate of return of 3.5 percent.

To better understand the impact of the credit, it is helpful to consider the impact on the required before-tax gross (of depreciation) rate of return, also referred to as the user cost of capital. For the case when expensing is allowed, but no credit is given, the user cost of capital equals 20 percent under the assumptions given in Table 5. A general result for investment tax credits is that the required user cost of capital declines in proportion to the credit rate, assuming the credit amount reduces the deductible portion of the investment by the amount of the credit, i.e., assuming a basis adjustment. The 20-percent credit rate (13-percent reduced credit) under the regular method reduces the required user cost of capital by 20 percent, to 16 percent. The four percentage-point decline in the user cost of capital is the same four percentage-point decline in the required net rate-of-return (from 5 percent to 1 percent).

This analysis implies that the combination of expensing and the R&E credit provides a strong enough incentive that taxpayers should be willing to accept (before-tax) returns to R&D that fall below what they could earn on investments on tangible capital. Under the assumptions used in Table 5, the required user cost of capital for investment in R&D falls by 15 to 26 percent below an alternative investment in a piece of equipment, which translates to a reduction in the required rate of return of approximately 3 to 6 percentage points.

Effect of the Credit on R&D Spending

Effect of the Credit on R&D Spending

The empirical literature generally finds evidence that the R&E credit has increased research spending by private businesses in the U.S. The preliminary evidence on the R&E credit from the early 1980s found very little impact on research spending, e.g., a small elasticity.16 The price elasticity measures the percentage change in quantity caused by a one percent change in price (reported here in terms of absolute value). Evidence from the 1990s finds a roughly dollar-fordollar or greater increase in research spending with respect to the credit. Using financial statements for a sample of manufacturing firms from 1980 to 1991, Hall (1993) estimates that the short-run elasticity ranges between 0.8 and 1.5.17 Hines (1993) estimates the effect of changes in allocation rules of R&E expensing on multinational corporations. Relying on the variation in tax treatment of R&E expenditures across firms, he estimates that the elasticity is between 1.2 and 1.6. Surveying the empirical work at the end of the 1990’s, Hall and Van Reenen (2000) conclude an elasticity of one best represents the literature. More recent estimates suggest that an elasticity of one is still a good benchmark, though as before, there remains considerable variance in the estimates. There is also evidence that in some cases (i.e. smaller financially constrained firms) the elasticity may be larger.18 Bloom, Griffith, and Van Reenen (2002) conduct a cross-country analysis of 9 OECD countries including the U.S. and estimate a short run elasticity of only 0.1 and a long-run elasticity close to one. Comparing the impacts of R&D incentives across countries is difficult, however, as countries construct their policies to encourage research in different ways. For example, the authors use of aggregated data allow for little ability to control for firms in differential tax positions or to account for certain features of the tax incentive that would apply to only a portion of firms. In a more recent paper, Bloom, Schankerman, and Van Reenen (2013) estimate an elasticity of 0.7 using an unbalanced panel of U.S. firms found in Compustat from 1980-2001.

Rao (2016) is the most recent paper examining the U.S. R&E credit, however she only estimates the effect for the first decade of the credit, well before the introduction of the ASC. She uses confidential tax return data from the U.S. from 1981-1991 to re-estimate the effect of the R&E credit. She estimated a short-run elasticity and long-run elasticity that are both close to two, suggesting a strong response of reported QRE to the after-tax user price. She also matches some of the firms in the tax return sample with Compustat data. The measure of research in the Compustat data is broader than QRE reported on tax returns. She finds strong evidence that firms respond to the credit much more by increasing reported QRE than increasing overall research expenditures. Whether this represents a real shift in research activity towards the type of research expenditures that meet the qualifications for the credit, or whether this merely represents a relabeling of research expenditures that were already planned or conducted is unclear. Regardless of whether the shifting reflects a move out of non-qualifying research into qualifying research or relabeling, it does not represent an increase in research overall, and so casts some doubt on the real level of taxpayer responsiveness to the credit. Furthermore, the possibility of such shifting has colored interpretation of much of the earlier empirical literature on the effect of the R&E tax credit, since that research did not control for shifting.

Rationale for Promoting R&E

Rationale for Promoting R&E

Government support of R&D is widely accepted as appropriate by economists and policymakers because of the social benefits associated with research activities. Economic theory suggests that the social return to investment in research in a market economy would be greater than the private

return. Stated another way, investment in technical knowledge has positive spillover benefits that exceed the benefits received by the one making the investment. These spillovers occur because of two properties of technical knowledge. First, once an idea has been developed, it is difficult to prevent others from using the idea, say for example due to reverse engineering. Second, the consumption of an idea by one person does not reduce the amount of knowledge available to others. As a result, businesses may reject some research projects whose benefits to society exceed its private gains, leading to an under-investment in research in the economy.

Though it is difficult to measure the social returns to R&D, the empirical literature largely confirms that the social returns exceed the private returns. Hall, Mairesse, and Mohnen (2010) review of the empirical literature on the returns to R&D conclude that the private returns to R&D are typically higher than those to physical capital. Moreover, the social returns to R&D are almost always estimated to be substantially greater than private returns, though the estimates are often imprecisely estimated. A recent paper by Bloom, Schankerman and Van Reenen (2013) uses 1980-2001 U.S. Compustat data to estimate that the private (gross) rate of return to R&D equals 21 percent while the social rate of return equals 55 percent, more than twice the private return. If this estimate is accurate, then the socially optimal level of R&D is more than double the current level. This paper also estimates that smaller firms have smaller social returns as their technology is more specialized and fewer firms tend to benefit from the knowledge spillover.

There are numerous ways that governments seek to increase research activity. The government can directly conduct research through agencies, it can fund educational institutions, or it can offer grants to private entities to conduct specific research projects. Governments also seek to increase private returns to research spending through the protection of intellectual property rights, such as patents, trademarks and copyrights. Another option is to provide tax incentives that increase the after-tax return to research investment. The U.S. has long provided incentives for research spending through the tax code. Beginning in 1954, the tax code has allowed the deduction (expensing) or amortization of research expenditures, rather than capitalization, in order to eliminate uncertainty about the tax accounting treatment of research expenditures and to encourage taxpayers to carry on research and experimentation. In addition, as discussed above the R&E tax credit was enacted on a temporary basis in 1981 and was recently made permanent after numerous temporary extensions.

Each of these approaches may be appropriately suited for encouraging a certain type of R&D. One advantage of the tax credit is that it is a market-based approach and thus generally would support research activity that generates at least a market rate of return on average. It also allows a host of projects to be selected by many different private investors, and so promotes diversity that is difficult to obtain in government chosen or sanctioned projects. However, one limitation of the credit is that the projects with the highest private returns, and hence likely to be chosen by a profit-seeking taxpayer, are not necessarily those projects with the highest social returns.

Rationale for Promoting R&E

Rationale for Promoting R&E

Government support of R&D is widely accepted as appropriate by economists and policymakers because of the social benefits associated with research activities. Economic theory suggests that the social return to investment in research in a market economy would be greater than the private

return. Stated another way, investment in technical knowledge has positive spillover benefits that exceed the benefits received by the one making the investment. These spillovers occur because of two properties of technical knowledge. First, once an idea has been developed, it is difficult to prevent others from using the idea, say for example due to reverse engineering. Second, the consumption of an idea by one person does not reduce the amount of knowledge available to others. As a result, businesses may reject some research projects whose benefits to society exceed its private gains, leading to an under-investment in research in the economy.

Though it is difficult to measure the social returns to R&D, the empirical literature largely confirms that the social returns exceed the private returns. Hall, Mairesse, and Mohnen (2010) review of the empirical literature on the returns to R&D conclude that the private returns to R&D are typically higher than those to physical capital. Moreover, the social returns to R&D are almost always estimated to be substantially greater than private returns, though the estimates are often imprecisely estimated. A recent paper by Bloom, Schankerman and Van Reenen (2013) uses 1980-2001 U.S. Compustat data to estimate that the private (gross) rate of return to R&D equals 21 percent while the social rate of return equals 55 percent, more than twice the private return. If this estimate is accurate, then the socially optimal level of R&D is more than double the current level. This paper also estimates that smaller firms have smaller social returns as their technology is more specialized and fewer firms tend to benefit from the knowledge spillover.

There are numerous ways that governments seek to increase research activity. The government can directly conduct research through agencies, it can fund educational institutions, or it can offer grants to private entities to conduct specific research projects. Governments also seek to increase private returns to research spending through the protection of intellectual property rights, such as patents, trademarks and copyrights. Another option is to provide tax incentives that increase the after-tax return to research investment. The U.S. has long provided incentives for research spending through the tax code. Beginning in 1954, the tax code has allowed the deduction (expensing) or amortization of research expenditures, rather than capitalization, in order to eliminate uncertainty about the tax accounting treatment of research expenditures and to encourage taxpayers to carry on research and experimentation. In addition, as discussed above the R&E tax credit was enacted on a temporary basis in 1981 and was recently made permanent after numerous temporary extensions.

Each of these approaches may be appropriately suited for encouraging a certain type of R&D. One advantage of the tax credit is that it is a market-based approach and thus generally would support research activity that generates at least a market rate of return on average. It also allows a host of projects to be selected by many different private investors, and so promotes diversity that is difficult to obtain in government chosen or sanctioned projects. However, one limitation of the credit is that the projects with the highest private returns, and hence likely to be chosen by a profit-seeking taxpayer, are not necessarily those projects with the highest social returns.

Assessing the Effectiveness of the Credit

Assessing the Effectiveness of the Credit

The R&E credit can improve overall economic efficiency by encouraging firms to undertake R&D investments that provide a social return greater than alternative investments, but have a private return too low to be profitable apart from the tax subsidy. The existing empirical evidence regarding social and private returns to investment does not provide a precise estimate of the optimal size of the R&E credit. However, some evidence suggests that investment in R&D remains below the optimal level, as social returns to R&D are generally measured to be greater than returns to alternative investments. This suggests the credit rate may be insufficiently small or that other features of the credit limit its effectiveness at spurring greater R&D.

For example, high compliance costs are frequently cited as a reason that the credit is not more effective at spurring more R&D. The compliance burden arises from the need to compute the complicated credit and to maintain documentation dating back years (and even decades in some cases). In addition, the R&E credit has been the source of many disputes between taxpayers and the IRS. Some of these difficulties are unavoidable, such as determining and verifying qualifying research, but others stem from the design of the credit.

In addition, for many firms, the credit provides only a weak (or no) incentive because of the lack of tax liability for which to use the credit.

Given the difficulties in measuring the social welfare gains resulting from R&D, some studies have focused on measuring the relative cost-effectiveness of the credit, rather than its overall efficiency. This approach compares government spending through the R&E credit with the government directly funding research. If a dollar spent through foregone tax revenue under the R&E credit increases private research by at least one dollar, then the R&E credit is considered to be at least as cost-effective as a direct grant. The empirical research summarized above suggests that price elasticity is close to one. Thus in terms of first approximation, the tax credit is similar to a government grant in terms of cost effectiveness. It is important to note that because the allocation of R&D investments under a tax credit is not necessarily the same as it would be under a direct grant, the social welfare gains are not necessarily the same across these two vehicles even if these two programs are deemed to be equivalently cost-effective.

This cost-effectiveness comparison to government grants is valid for the next dollar spent, that is, the marginal dollar. The overall benefit-cost ratio for the R&E credit would be higher than the elasticity estimate because of the incremental nature of the credit, which reduces the average cost of the credit below the marginal cost in some cases. However, the difference between the average and marginal effective credit rates currently is not large for most taxpayers. Indeed, for only 3 percent of corporate research spending in 2013 did the marginal effective credit rate substantially exceed the average credit rate. For most research spending, the current research credit functions exactly or nearly as a flat-rate credit.

Alternative Credit Designs

Alternative Credit Designs

Several methods of computation have been used in the history of the credit, though all have sought to maintain the incremental nature of the credit. This has been motivated by an attempt to limit windfalls given to taxpayers for research that a business would have undertaken in the absence of the credit, so as to boost the cost-effectiveness of the credit. To limit these windfalls and direct more of the tax expenditure to marginal investments, the credit applies only to research above some base amount. Identifying a practical base amount is challenging. In theory, the most effective base level of research against which additional research spending is determined should correspond to research that would otherwise have been undertaken by a business, a counterfactual that is impossible to identify in practice. Finding a base that is a good proxy for research that would have been done without the credit has been a challenge throughout the history of the credit, and all of the options increase the complexity and compliance costs of the credit.

The original credit calculation used the average level of research spending over the previous 3-years as the base for the credit. However, this left many firms in a position where the effective credit was zero or negative. The regular method, enacted in 1989, replaced that calculation. The advantage of using a base that does not update with time (as used in the regular method) is that current year research spending does not affect the base for future years, and hence reduce the value of the credit in future years. However, the base amount calculation for the regular credit has become increasingly outdated and irrelevant to recent research experiences, and so is increasingly a poor proxy for the level of research that might have been done in the absence of the credit.

Furthermore, the regular method’s computation relies on information from the 1980’s for many taxpayers, which raises compliance costs. For companies that have been in existence and engaged in research activities during that period, obtaining and retaining historic information in the event of an IRS examination is burdensome (and often impossible). As taxpayers engage in corporate acquisitions and dispositions, this historic information may need to be combined with data from acquired businesses or segregated for a disposition. Retaining historic information may be even more challenging for businesses that form part of a controlled group or businesses that are under common control and therefore must aggregate credit information.

The ASC method, enacted in 2006, attempts to address concerns about using a moving average base by reducing the average of the prior years’ research expenses by 50 percent so that it is easier to exceed the base. It has proved a popular alternative to the regular method, and arguably provides a better measure of the base level of research expenses as it is based on recent research experience. Also, the ASC does not need to measure gross receipts, which eliminates one area of potential controversy between the IRS and taxpayers.

It is difficult to precisely measure the total compliance costs of the regular method. However, the popularity of the ASC compared to the regular method, despite the ACS’s relatively less favorable tax benefits (in terms of statutory, effective, and average credit rates), suggests that the compliance costs of the regular method are substantial. Firms using the ASC conduct more than twice the level of qualifying research than firms using the regular method, while receiving on average a smaller total credit. This comparison does not mean that all firms using the ASC receive a smaller credit than if they would have used the regular method. Many of the firms using the ASC likely choose to do so precisely because the ASC generates a larger credit for that year. Nevertheless, the use of the ASC seems greater than would be simply predicted from comparing average credit rates.

Both the regular method and the ASC use past research experience to determine the base amount of research spending for the current year, with the main difference that the regular method uses an experience fixed in time (1984-1988) and the ASC is self-updating through time. Another approach would be to set the base amount according to a rule-of-thumb. For example, the credit could be applied to research spending above a base determined as certain share of gross receipts. This is similar to the design of the alternative incremental research credit (AIRC), a computation method allowed for the R&E credit for years 1996 through 2008. This approach is simpler than the other incremental options, as only current-year information is needed to calculate the credit. However, under this approach, it seems more likely that some taxpayers typically would have research spending below the base and would be ineligible for the tax credit even though they might be responsive to the credit if eligible. This becomes more of a problem the higher the base amount and the greater variance there is among taxpayers (and over time for a given taxpayer). Another problem with an AIRC type credit is bunching, which would occur to the extent that taxpayers delay research projects until they have accumulated enough QRE in one year to exceed the base and qualify for the credit.

Another drawback to incremental credits in practice is that firms face uneven incentives. Some firms face the full marginal rate, some face the capped rate, and other firms may face a zero rate (or negative rate in case of the ASC) under unusual research spending patterns. There are two main problems with this dispersal of rates. First, it is unlikely that the highest marginal rates are faced by firms most likely to undertake the investment projects with the highest social returns fora given year, in which case the different marginal rates are likely to lead to an inefficient allocation of research spending across firms. Second, it is unclear how aware managers are of the firm’s effective credit rate when making decisions regarding research spending, but it would be expected that the possibility that the firm may end up in a low rate situation would mute the incentive effect of the credit

Furthermore, incremental credits are likely to be pro-cyclical.34 That is, at a time of an economy-wide or industry-wide downturn, firms are more likely to be below their base amount, which makes it more likely the credit provides no incentive to expand R&D investment during the downturn. This in turn acts to exacerbate the business cycle.

In its FY 2017 Budget, the Administration proposed modifying and slightly expanding the R&E tax credit. In several ways, the Administration’s budget proposal for the R&E credit would mitigate some of the problems with the current credit. To reduce compliance and administrative burdens, the regular method would be repealed. To maintain incentives for those taxpayers currently using the regular method, the ASC rate would be increased to 18 percent, which would bring the effective credit rate under the ASC to approximately equal the effective credit rate under the regular credit for those constrained by the 50 percent minimum base. This would also boost the incentive for increasing research for those taxpayers already using the ASC, which is consistent with the evidence regarding the optimal size of the subsidy.

Recognizing that the inability to use the credit in the current-taxable year reduces the effective incentive of the credit, the Administration also proposes to allow all taxpayers to claim the credit against AMT liability. This would increase the likelihood that taxpayers could use the credit in the current year and would be simpler as firms near the current gross receipts cut-off will no longer need to track their eligibility. In particular, this would tend to help entities organized as pass-through entities, as AMT liability is more of a barrier for taking the credit for such entities.

Nevertheless, further reforms to the form of the credit may be warranted. One option would be to allow full refundability of the credit. This would increase the incentive effect of the credit and may be helpful in reducing liquidity constraints for certain firms. However, there are some administrative concerns with making the credit fully refundable. The potential for significant taxpayer abuses of the credit would likely lead to an increase in administrative and compliance costs. Nonetheless, the PATH Act of 2015 allows partial refundability of the credit against payroll taxes for qualifying small businesses. The effects of this provision should be examined to see if expanding this option to other firms would be an effective alternative to full refundability.

In addition, the evidence indicates that the current calculation methods are nearly equivalent to a flat-rate credit for the vast majority of taxpayers. This suggests adopting a flat-rate credit with an effective credit rate similar to the current calculation methods would provide similar incentives at a similar budgetary cost, with less administrative and compliance costs, and potentially less concern over collateral effects such as exacerbating the effects of the business cycle.

About ABGi USA

Business leaders choose ABGi as their tax incentive specialist because, for over 30 years, our expertise has allowed us to maximize their credits and deductions, decreasing tax liability the way the government intended. Our approach to work minimizes business disruption and produces high-quality, compliant work.

Contact us today!

References:

Agrawal, Ajay, Carlos Rosell, and Timothy S. Simcoe. 2014. “Do Tax Credits Affect R&D Expenditures by Small Firms? Evidence from Canada. National Bureau of Economic Research Working Paper 20615.

Altshuler, Roseanne. “A Dynamic Analysis of the Research and Experimentation Credit.” National Tax Journal, Vol. 41, No. 4, pp. 453-66, Dec 1988.

Bloom, Nick, Rachel Griffith and John Van Reenen. 2000. “Do R&D Tax Credits Work? Evidence from a Panel of Countries 1979-1997.” Journal of Public Economics 85:1-31.

Bloom, Nicholas, Mark Schankerman, and John Van Reenen. 2013. “Identifying Technology Spillovers and Product Market Rivalry.” Econometrica 81(4):1347-1393.

Dechezleprêtre, Antione, Elias Einiö, Ralf Martin, Kieu-Trang Nguyen, and John Van Reenen. 2016. “Do Tax Incentives for Research Increase Firm Innovation? An RD Design for R&D.” National Bureau of Economic Research Working Paper 22405.

Eisner, Robert, Steven Albert, and Martin Sullivan. “The New Incremental Tax Credit for R&D: Incentive or Disincentive,” National Tax Journal, Vol. 37, No. 2, pp. 171-183, 1984.

General Accountability Office. 2009. The Research Tax Credit’s Design and Administration Can Be Improved. GAO-10-136.

Gravelle, Jane. 1993. “What can Private Investment Incentives Accomplish? The Case of the Investment Tax Credit,” National Tax Journal 46(3):275-90.Guenther, Gary. 2016. Research Tax Credit: Current Law and Policy Issues for the 114th

Congress. Congressional Research Service, RL31181. Hall, Bronwyn. 1993. “R&D Tax Policy During the 1980s: Success of Failure?” in James Poterba, ed. Tax Policy and the Economy. Vol. 7, 1-35.

Hall, Bronwyn, Jacques Mairesse, and Pierre Mohnen. 2010. “Measuring the Returns to R&D,” in Bronwyn Hall and Nathan Rosenberg (eds.) Handbook of the Economics of Innovation (Amsterdam: Elsevier), pp. 1034-1076.

Hall, Bronwyn and John Van Reenen. 2000. “How Effective are Fiscal Incentives for R&D? A Review of the Evidence.” Research Policy, Vol 29, 449-469.

Hines Jr., James. 1993. “On the Sensitivity of R&D to Delicate Tax Changes: The Behavior of U.S. Multinationals in the 1980s.” In Giovannini, A,. Hubbard, R.G., and Slemrod, J. (Eds.) Studies in International Taxation (University of Chicago Press: Chicago), pp.149-194.

Jones, Charles and John Williams. 1998. “Measuring the Social Return to R&D.” The Quarterly Journal of Economics.

Mansfield, Edwin. “The R&D Tax Credit and Other Technology Policy Issues,” American Economic Review, Vol. 72, No. 2, pp 190-194. May 1986.

Rao, Nirupama. 2016. “Do Tax Credits Stimulate R&D Spending? The Effect of the R&D Tax Credit in its First Decade.” Journal of Public Economics, 140:1-12.