On October 15th, 2021, the Internal Revenue Service (“IRS”) released Chief Counsel Memorandum 20214101F (“Memorandum”), which set forth the information taxpayers must provide with administrative claims for a refund or credit under Internal Revenue Code (“IRC”) Section 41, also known as the Research and Development (“R&D”) Tax Credit.

This guidance focused on the information that must be provided for the claim to be valid under Treas. Reg. § 301.6402-2(b)(1), which states that a credit claim or refund must include sufficient information to apprise the IRS of the nature of the claim.

Prior to this Memorandum, only Form 6765, Credit for Increasing Research Activities, and a brief statement as to the reason for the amended tax return were required to be completed with the qualified research expenditures for an R&D Tax Credit claim.

Following the Memorandum, the IRS requires taxpayers to provide the information listed below with an R&D Tax Credit claim that is included in refund claims:

- Identify the business components for the Section 41 research and development credit claim.

- Identify the research activities performed, the individuals who performed each research activity, and the information the individuals sought to discover for each business component.

- Provide the total qualified employee wage expenses, total qualified supply expenses, and total qualified contract research expenses for the claim year (this may be done using Form 6765, Credit for Increasing Research Activities).

This information must be submitted when the refund claim is filed in conjunction with a declaration signed under penalty of perjury verifying that the information provided is accurate. In most cases, the signature provided on the amended tax return served this function.

The IRS stated that these requirements would allow them to better determine whether an R&D tax credit refund claim should be paid immediately or whether further review was warranted. If the IRS determined that an R&D Tax Credit refund claim did not meet the new requirements, they would deem the credit claim deficient and would not consider it. If a claim was deemed deficient, the IRS responded to the claim with a letter stating so.

However, this notice would not include any specific reasons for why the claim was deficient or what was needed to cure the deficiency. The IRS did provide a grace period to perfect deficient credit claims, which has now been extended to January 10, 2025.

IRS Breaks the Silence

Taxpayers and tax preparers were left in the dark as to the preferred manner, extent of information, and format the IRS wanted the additional information to be provided.

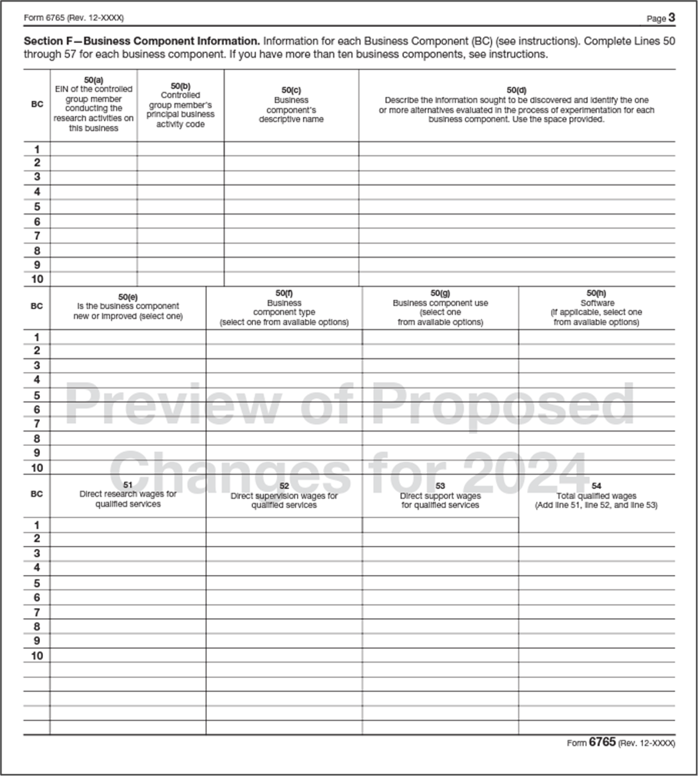

On September 15, 2023, nearly two years after announcing the additional information requirements, the IRS announced proposed changes to Form 6765. These proposed changes provide taxpayers with a consistent and predefined format for tax reporting. Regarding the required business component information, an excerpt of the proposed form is provided below.

Of course, the vast majority of R&D tax credit claims will necessitate that the information called for be provided in an attachment. However, the IRS providing clarity as to their expectations is extraordinarily helpful to taxpayers in ensuring that the information provided with an R&D credit claim will be sufficient.

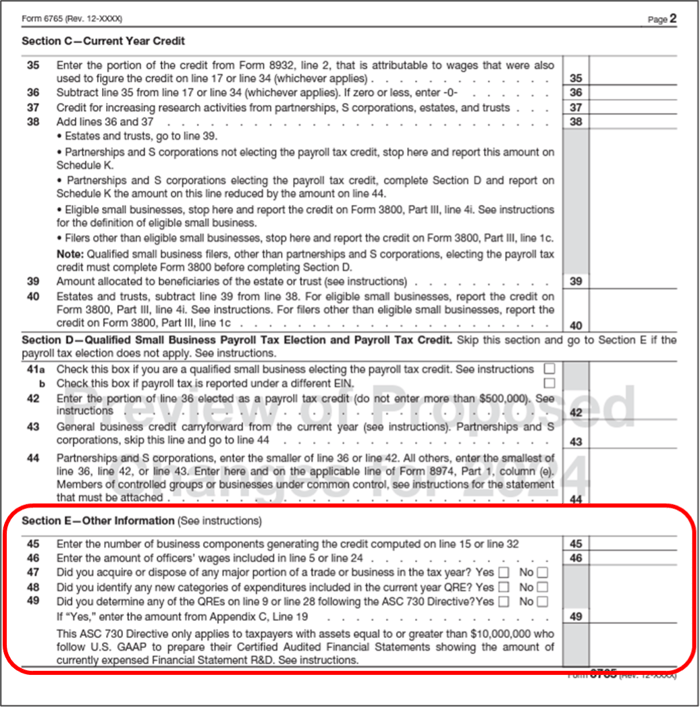

The IRS also included several administrative questions in their proposed changes to Form 6765. These can be found highlighted in the red box below.

Effects of the Proposed Changes

While the questions in the new Section E may at first glance seem rather benign, they provide some insight into the IRS’ thought process when initially reviewing an R&D Tax Credit claim. The IRS has steadily been taking steps to incorporate the use of data analytics to process tax return filings more efficiently. The questions included in Section E would provide additional data points to determine if further resources are required to evaluate the claim and then route it accordingly.

For example, line 45 would help determine the average amount of qualified expenses per business component. Line 46 would provide what percentage of total qualified wage expenses were generated from wages paid to officers. If either item fell within thresholds determined by the IRS, it could tag the claim as needing further review. Acquisitions or dispositions could affect the amount of qualified expenses claimed for the credit. It may also affect the reported base amount as annualization or de-annualization of a base year's costs may be necessary, which can be a complex exercise.

Line 50(d) in Section F requests a description of the information sought to be discovered and the identification of one or more alternatives evaluated in the process of experimentation. It requests that the information be given in the rather limited “space provided,” which may make it difficult to provide the level of detail required by the IRS. It is also important to note that the IRS has stated it is considering the completion of Section F as optional for certain smaller taxpayers.

At this point, it is not clear if the proposed changes to Form 6765 will be fully or partially adopted or adopted with modifications. The proposed changes would increase the reporting burden on most taxpayers and significantly increase the amount of data that a taxpayer sends to the IRS.

The detailed nature of the requested information suggests that the IRS intends to use Form 6765 as a risk-assessment tool or to conduct a "pre-audit" of the taxpayer's R&D Tax Credit. Taxpayers should consult their tax advisers to evaluate what impact the proposed form changes could have on their evaluation, identification, and documentation of the research credit and the timing that would be needed to complete the required information.