Written By: Shelley Parker and Mark Stapleton

The wait is over! Since June 2024, CPAs and R&D practitioners have eagerly awaited the Internal Revenue Service’s (“IRS”) finalized version of form 6765 Form 6765 (Rev. December 2024) for the Credit for Increasing Research Activities (“research tax credit”). The updated form introduces significant changes that increase both the amount and level of detail of information that must be provided in a research tax credit claim.

Major Updates:

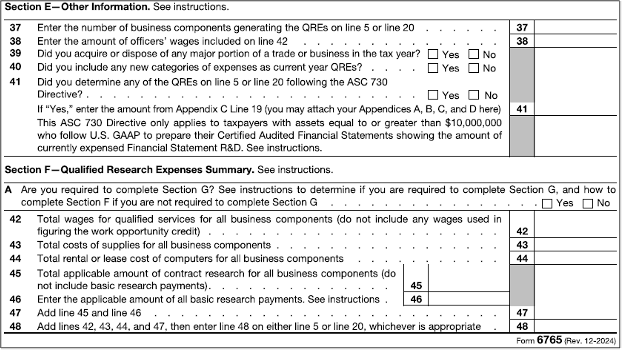

- Sections E - G feature the most substantial changes.

- Section E (mandatory for tax years 2024 onward) requires taxpayers to report the number of business components, officers' research wage expenses, whether any new categories of expenses were included in the credit calculation, and any major trade or business acquisitions/dispositions that occurred in the credit year. These details will help the IRS identify claims that deviate from established benchmarks and prior research tax credit claims submitted by the taxpayer. However, terms like "major portion of a trade or business" and "officers' wages" remain undefined and hopefully will be addressed in subsequent guidance.

- Top of the form: Questions A and B now ask about the 280C election and controlled group membership at the top of the form, rather than in both Sections A and B.

- Section F consolidates information from Sections A and B to save space on the form, with a new question on whether the taxpayer is required to complete the new and cumbersome Section G.

New Upfront Requirements and Increased Documentation

The form establishes new upfront requirements for research tax credit claims included in original return filings mirroring those requirements established for claims included in amended returns in the October 2021 IRS Chief Counsel Memorandum 20214101F (“ IRS Memorandum”) 20214101f.

- Section G gathers detailed business component data, including names, types (Product, Process, or All Others), and software classifications (internal-use, dual-function, non-internal-use, and exceptions). Line 49(f) requires a description of the information that a taxpayer sought to discover by business component. Staying consistent with the previously mentioned IRS Memorandum, line 49(f) is currently only required for amended returns. Any business that undertakes more than a few R&D efforts per year will understand the monumental task of 1) gathering uncertainty information for each effort and 2) summarizing complex research efforts into the small space provided on the new form 6765. Form instructions provide that a taxpayer must report no more than 50 business components in section G, comprising at least 80% of the credit year’s Qualified Research Expenditures (“QREs”) in descending order. It is likely that the uncertainty detail required on line 49(f) will have to be provided in a separate attachment due to the modest space allocated on the form. Fortunately, section G is optional for tax year 2024. After that, taxpayers with credit year QREs totaling more than $1,500,000 and average annual gross receipts for the three prior tax periods greater than $50,000,000 will be required to complete section G.

- Lines 50-52 break down qualified research wages into direct research, supervision, and support, reminiscent of the court ruling in Little Sandy Coal Company, Inc. v. Commissioner (“Little Sandy Coal”). In Little Sandy Coal, the Tax Court addressed whether certain wage expenses qualified for the research tax credit. The court ruled that the company failed to adequately document how employee activities met the criteria for qualified research. This case underscores the importance of detailed record-keeping to substantiate research tax credit claims.

- Lines 54-56 detail costs for supplies, computer rentals, and contract research by business component. While this information is not new, separating these costs by R&D effort is a new field required on this form. Taxpayers without proper cost-accounting methods may find this section difficult to complete without the help of a tax professional that has extensive experience in this area.

We discussed these changes in 2023 with our article, The New Landscape for Claiming the R&D Tax Credit. Since publishing the draft versions, the IRS has changed very little about the final versions of the form 6765 and its instructions.

With the publication of this new form, the IRS continues its efforts to gather detailed research tax credit documentation to support taxpayers' claims. With recent tax court decisions from cases like Leon Max v. Commissioner and Phoenix Design Group v. Commissioner which highlight how a taxpayer’s inability to provide sufficient information or documentation to substantiate their research activities can have significant impacts the credit claim, it is no surprise that the IRS feels empowered to require more information from taxpayers.

More Complexity:

A taxpayer must provide the information requested on the new form 6765 for its claim for the research tax credit to be considered valid under Treasury Regulation § 301.6402-2(b)(1), which states that a credit claim or refund must include sufficient information to apprise the IRS of the nature of the claim. Navigating the updated form 6765 requires understanding of complex, year-specific requirements, proper documentation methods, and new rules derived from years of tax court decisions. At ABGi, our research tax credit specialists not only ensure full compliance but also leverage deep industry expertise to optimize your tax credits. Our commitment is to guide you through these evolving requirements efficiently, helping you secure the tax savings you deserve.

To receive email updates on the latest 174 and R&D credit news, enter your email: